I love a mispriced gamble.

… even a horse with a very high likelihood of winning can be either a very good or a very bad bet, and the difference between the two is determined by only one thing: the odds. A horseplayer cannot remind himself of this simple truth too often, and it can be reduced to the following equation:

Value = Probability x Price

This equation applies to every type of horse and bet you will ever make. A horse with a 50 percent probability of victory is a good bet at better than even money (also known as an overlay) and a bad bet at less (a.k.a. an underlay). A 10-1 shot to whom you take a fancy is a wonderful overlay if he has a 15 percent chance of victory and a horrendous underlay if his true chance is only 5 percent. There are winning $50 exacta payoffs that are generous gifts and $50 exacta payouts where you made a terrible bet.

Now ask yourself honestly: Do you really think this way when you’re handicapping? Or do you find horses you “like” and hope for the best on price? Most honest players will admit they follow the latter path.

This is the way we all have been conditioned to think: Find the winner, then bet. Know your horses and the money will take care of itself. Stare at the past performances long enough and the winner will jump off the page.

The problem is that we’re asking the wrong question. The issue is not which horse in the race is the most likely winner, but which horse or horses are offering odds that exceed their actual chances of victory.

This may sound elementary, and many players may think they are following this principle, but few actually do. Under this mindset, everything but the odds fades from view. There is no such thing as “liking” a horse to win a race, only an attractive discrepancy between his chances and his price. It is not enough to lose enthusiasm when the horse you liked is odds-on or to get excited if his price drifts up. You must have a clear sense of what price every horse should be, and be prepared to discard your plans and seize new opportunities depending solely on the tote board…

Sticking to your guns is easier said than done, but it is the only way to win in the long run. The horseplayer who wants to show a profit must adopt a cold-blooded and unsentimental approach to the game that is at variance with both the “sporting” impulse to be loyal to your favorite horses and the egotistical impulse to stick with your initial selection at any price. This approach requires the confidence and Zen-like temperament to endure watching victories at unacceptably low prices by such horses.

- Steven Crist. Bet With the Best: Expert Strategies from America's Leading Handicappers

Ask ChatGPT to substitute “horse” with “stock”, and Crist’s words still hold true.

The stock market is surprisingly similar to a pari-mutuel betting system. Situations arise when there’s a discrepancy between the odds laid by the collective bettors and the true expected value of the bet. These mispricings become your opportunity.

Today we will review one such opportunity.

First smitten, then scorned

Galaxy Gaming (GLXZ) develops and distributes casino table games and electronic wagering systems. Their main business is licensing games to brick-and-mortar casinos - they get paid both a flat rate and a percentage of revenue earned. As the creator of the 21+3 blackjack side bet game that is a staple in casinos around the world, they are liked by both casino patrons (who stand to win a higher payout than what tey’d receive from traditional blackjack) and the casinos themselves (whose edge is as high as 20% when they offer Galaxy’s games). Their secondary business is the the also develop and licensing of games to iGaming operators, a segment of the gaming industry which has experienced -- and forecasted to continue experiencing -- rapid growth.

GLXZ is the village bicycle amongst microcap value investors - seemingly everyone has had a ride at some point.

It’s easy to see what stoked infatuation amongst investors:

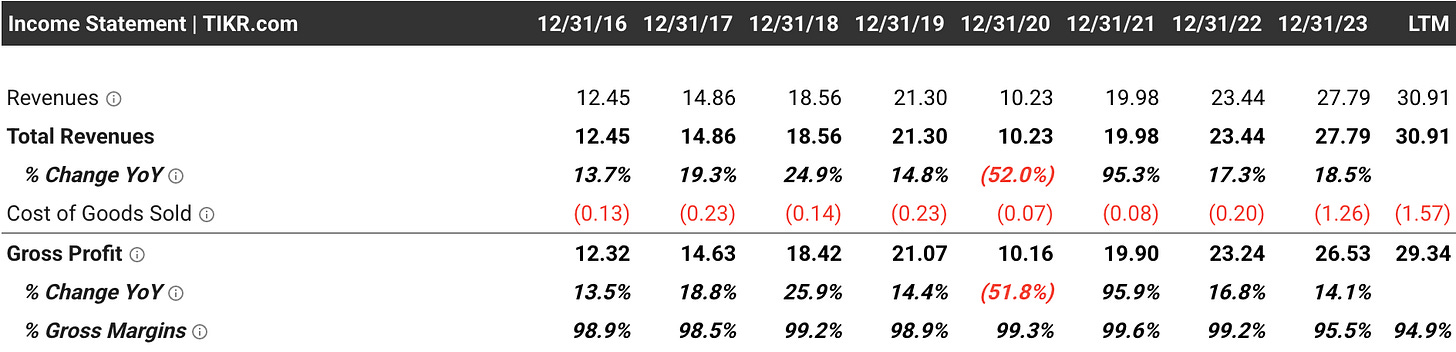

95% gross margins and double-digit free cash flow yield

Capital light business model

Customer captivity (gamblers strongly prefer 21+3 to competitor variants)

Iron-clad barriers to enter(legally enforceable intellectual property, exclusive distribution with the likes of juggernauts like Evolution)

Economic tailwinds (jurisdictions the world over continue to legalize both brick-and-mortar and internet gambling)

But the object of investor’s affection lived a tumultuous life, including a court battle with the founder and CEO Robert Saucier who owned ~58% of the common stock. GLXZ prevailed in the end, but at a cost of $39 million plus legal expenses. They had to finance the share redemption, and as a microcap company in an industry of vice and sin, they were stuck with floating rate debt. During the go-go years where debt was almost free, this wasn’t a problem. But then rate hikes reared their ugly heads and virtually all of GLXZ’s cash flow was allocated toward a ~$60mm loan balance bearing interest at rates in excess of 13%. The stock price responded in kind. The CEO was suddenly fired without warning. The CFO failed to refinance the debt at more reasonable terms and departed the company. Limerant no more, investors stopped caring about the company.

Then, a material change.

In July 2024 it was announced that GLXZ’s largest customer, Evolution, was to acquire the company at a price of $3.20 per share with a close date of mid-2025. The stock price nearly doubled before settling at a ~15% discount to the takeout price, and it’s been there ever since.

I can’t quit you, baby

I owned GLXZ for a number of years leading up to the merger announcement. The news of the sale evoked a duality inside me. Like others, I felt a tinge of rage at the company for selling itself for what could be a 50% discount. Years of holding this thing through the ups and downs and now I’m going to get a return dwarfed by what I could have earned had I just held the S&P? At the same time I felt relief - the dopamine hits of great results, new contracts, new acquisitions were always short-lived. Something always came up that put the companies future cash flows in doubt. So much for the afterglow. I sold my stake on the merger news and walked away.

I’m taking a look, again. It’s February, and the stock price is languishes in the $2.75-$2.80 range. GLXZ shareholders approved the merger. The company continues to perform well. The new CEO and CFO are experienced and appeared to be doing the right things. Evolution nor regulators show any sign of walking back the merger, and if they do there’s a $5+ million breakup fee:

They also refinanced the debt last month, going from LIBOR + 7.5% down to SOFR + ~3.5%.

To top it all off, Galazy’s EZ Baccarrat recently became the game of choice for Evolution’s Ezugi subsidiary, which is distribute the game to their network of live dealer operators around the world (including DraftKings!)

The juice is worth the squeeze

I think the opportunity is compelling. Despite the history, the bull case is relatively simple to understand: Buy today at a ~14% spread to the takeout price and hold until close, you get an annualized return of around 24%. If for some reason the deal falls through, you own a business with tremendous earnings power that has strong barriers to entry, a cleaned up capital structure, a seemingly competent management team at the helm, and continued tailwinds from favorable gaming legislation. And you get it at what appears to be a reasonable price

Management’s projections for the future are as follows:

One should take these projections with a grain of salt -- perhaps especially so in this case given the history of the company -- but the economics of the business are quite good, so the optimism may be justified.

This is not investment advice. Please do your own work to understand this business and its history before making any decisions.

I just made a post on GAN funny enough. I think its a better short term bet. I also own some Galaxy.